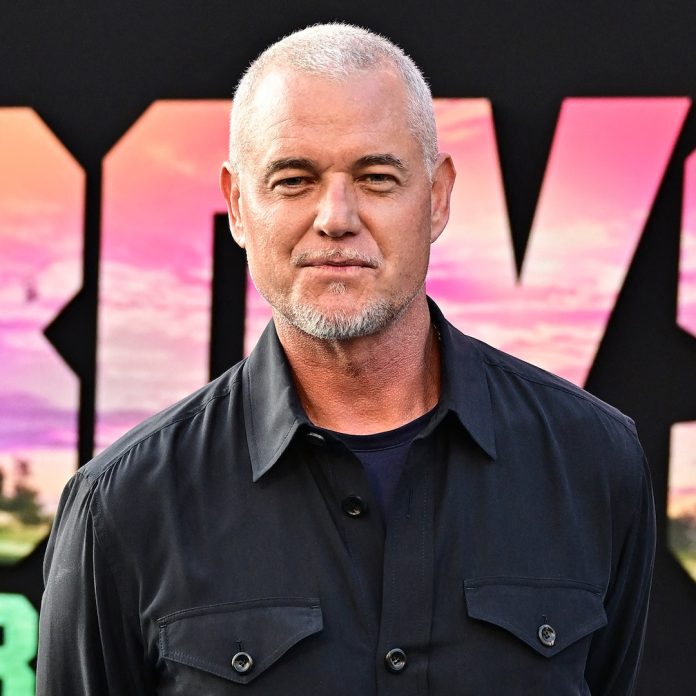

Eric Dane is getting McSteamy once again.

The Grey’s Anatomy alum appeared to debut a new relationship with filmmaker Janell Shirtcliff at the premiere of Prime Video’s Countdown in Los Angeles June 18.

Dane—who shared his diagnosis with ALS in April—stepped out on the red carpet hand-in-hand with Shirtcliff, who donned a red pinstripe blazer dress for their public debut.

The photographer—who has taken celeb portraits of Dua Lipa, Jenna Ortega and Kate Hudson—accessorized her look with a green handbag and aviator shades, while he kept it summer chic in a casual pair of beige trousers worn with a tee and white sweater.

At one point on the carpet, the couple shared a laugh while looking into each other’s eyes.

E! News has reached out to their reps for comment on the relationship, but hasn’t heard back.

Prior to his apparent romance with Shirtcliff, Dane was in a relationship with Rebecca Gayheart, whom he married in 2004. Though she filed for divorce in 2018, Gayheart—who shares kids Billie, 15, and Georgia, 13, with the actor—filed to dismiss her divorce petition in March 2025, with him signing off on the move to stay legally married.