Several Senate Republicans who have withheld their support for the party’s massive tax and spending package signaled on Monday that they weren’t swayed by details unveiled by GOP leaders earlier in the day.

The text released by the Senate Finance Committee Monday included some of the most controversial issues Republicans have been wrestling with — including Medicaid, taxes and green energy tax credits — and contained a number of departures from the House-passed version of the legislation.

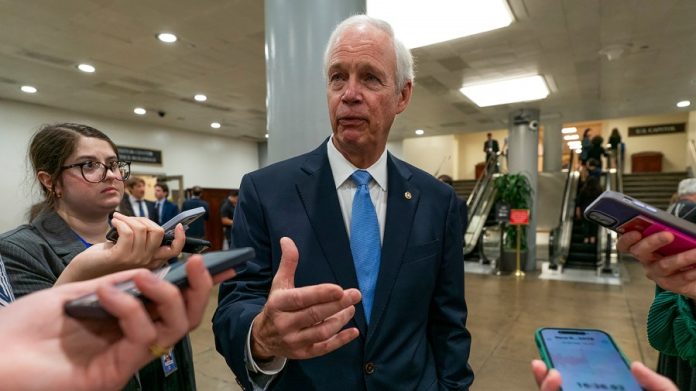

But Sens. Ron Johnson (R-Wis.) and Josh Hawley (R-Mo.), two preeminent critics of the bill, made clear they are dissatisfied by changes.

Johnson, who has been perhaps the most vocal critic of the emerging package, did not sugarcoat his feelings after emerging from a meeting of the Senate GOP conference held to brief members on the bill.

“We’re not doing anything to significantly alter the course of the financial future of this country,” Johnson said, noting that he plans to release a report of his own in the coming days to explain “why I’m not particularly uplifting” about the financial state of the nation.

“It just simply doesn’t meet the moment. It’s inadequate,” he continued.

Johnson has consistently panned the bill for not cutting enough spending, having called for a return to pre-pandemic levels.

He has also been subject to intense lobbying by the White House as he holds many of the cards over the potential passage of the bill. But he argued the legislation nowhere near ready for prime time and will likely slip past the party’s self-imposed July 4 deadline.

“Not by July 4th. No way,” he added.

Hawley, meanwhile, has constantly drawn a red line around Medicaid cuts, saying he would oppose any bill that cut benefits.

On Monday he complained that the bill included delays to the phaseouts of renewable energy subsidies while also containing Medicaid cuts that would impact rural hospitals.

The Senate bill took a more flexible approach to the phaseout of the tax credits included in President Biden’s Inflation Reduction Act that the House-passed bill did, but took a bigger swing at Medicaid.

“That’s going to be a hard argument to make in Missouri,” Hawley said.

Of the text writ large, he added, “It sounds to me like this needs some work.”

GOP leaders view the pair as critical to win over to pass the bill, especially if they want any hope of having a final version on President Trump’s desk by the nation’s birthday.

There were also no signs from Sen. Susan Collins (R-Maine), a leading moderate, that she is on board with the bill yet. She declined to comment on the updated text language as she departed the meeting.

Collins has repeatedly raised concerns about the impact of the House-passed Medicaid spending cuts.

Sen. Rick Scott (R-Fla.), another holdout, indicated that he is not yet in the “aye” column as well, telling reporters that he is still going through the updated text. He has been among those calling for more spending cuts, though his vote has been viewed by leaders as not as heavy of a lift as Johnson’s.

The Senate GOP can afford to lose a maximum of three votes. Sen. Rand Paul (R-Ky.) has been widely considered a definite “no” vote over his opposition to an increase of the debt ceiling that was included, meaning they can only lose two additional votes.

Senate Finance Committee Chairman Mike Crapo (R-Idaho) unveiled the package during a special conference meeting on Monday evening, with members acknowledging that the process is far from over.

“It’s just what you expect: Everybody’s got an opinion, and I think it’s going to be that way right up until we vote,” said Sen. John Hoeven (R-N.D.). “It’s still a work in progress.”

Finance’s language included numerous changes from the House’s package, which Senate Republicans have been clamoring for.

Headlining those are a proposal to tighten eligibility requirements for Medicaid and lower the provider tax in expansion states to 3.5 percent — down from 6 percent.

The Child Tax Credit also was raised to $2,200 in the upper chamber — compared to the $2,500 level in the House.

One contentious issue that remains up in the air is what will happen to the State and Local Tax (SALT) deduction cap.

The Finance panel’s text holds the cap steady at $10,000 — one quarter of the $40,000 cap in a deal House members from New York, New Jersey and California struck with Speaker Mike Johnson (R-La.).

Senate Republicans, none of whom hail from high-tax blue states, have shown little appetite to abide by that deal. But they are cautioning that the $10,000 price tag is one in name only.

“We understand that it’s a negotiation,” Senate Majority Leader John Thune (R-S.D.) said. “Obviously. there had to be some marker in the bill to start with, but we’re prepared to have discussions with our colleagues here in the Senate and figure out a landing spot.”

Numerous House GOP members from those states spoke out forcefully against any changes to the House deal, saying that they will not accept anything lower than the agreement they already struck with Johnson.

Sen. Markwayne Mullin (R-Okla.), the chamber’s informal liaison to the House, told reporters that he spoke with Rep. Mike Lawler (R-N.Y.), among others, in an attempt to calm the waters.

“Everything is being negotiated. Everything’s being talked about,” he said. “Everybody’s got an idea. Like I said, everybody wants their fingerprints on it and make the bill better and that’s what I think we’ll do.”

Alexander Bolton contributed.