BBC business reporter

Getty Images

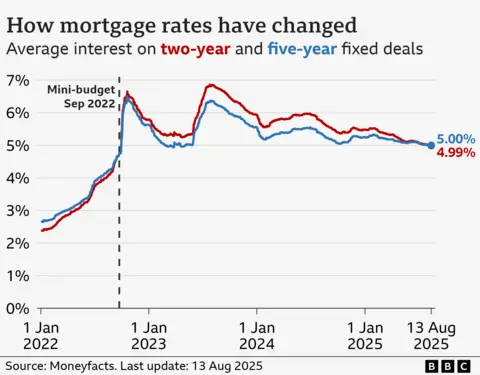

Getty ImagesThe average two-year mortgage rate has dipped below 5% for the first time since former Prime Minister Liz Truss’s mini-budget in September 2022, figures show.

The rate has dropped to 4.99%, according to Moneyfacts, which described it as a “symbolic turning point” for homebuyers and shows lenders are “competing more aggressively”.

Interest rates have been cut five times since last August but at the Bank of England’s last meeting, a split vote between policymakers raised questions about whether there would be another reduction this year.

A Moneyfacts spokesperson said that although mortgages are following the “mood music” set by the Bank’s rate cuts, they are unlikely to fall substantially.

Hundreds of thousands of borrowers are due to re-mortgage this year.

UK Finance, the banking industry group said 900,000 fixed rate deals are due to expire in the second half of 2025, while the total for the year is 1.6 million.

Mortgage rates are still “well above the rock-bottom rates of the years immediately preceding” the mini-budget, according to Moneyfacts.

Unveiled by Truss’s short-lived chancellor Kwasi Kwarteng, the so-called mini-budget set out £45bn in unfunded tax cuts, causing UK market turmoil.

It pushed up the cost of UK government borrowing, which fed through into mortgage rates. By July 2023, the borrowing cost of mortgages had soared to the highest level since the 2008 financial crisis.

Last week, the Bank of England revealed that inflation is forecast to spike higher than expected this year – at 4% in September – before falling back to its 2% in 2027.

Moneyfacts said this “is likely to mean the base rate will hold around its current level for longer” which, after the last cut, is 4%.