The Middle East is anticipated to be a pivotal region in terms of the global conventional refinery capacity additions, expected to contribute over a quarter of the total capacity additions by 2030. This growth is underpinned by large-scale projects, particularly in Iran and Iraq. Both countries are leveraging their vast crude oil reserves to expand refining infrastructure, aiming to meet rising domestic demand, reduce imports of refined products, and strengthen export capabilities.

Iran is set to dominate conventional refinery capacity additions in the Middle East, accounting for over 40% of the region’s capacity additions by 2030. This can be attributed to several factors, including government support, strategic infrastructure expansion, and a focus on energy self-sufficiency.

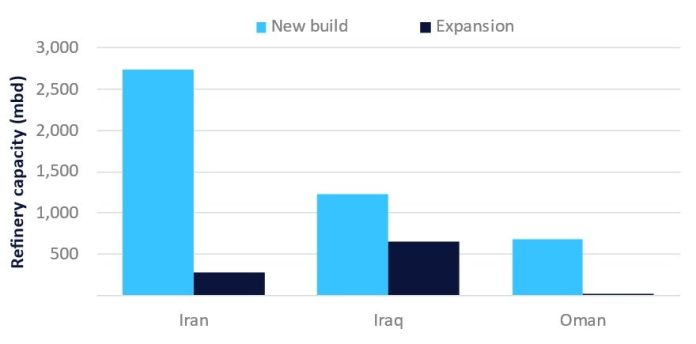

A total of 15 new-build and expansion projects are expected to come online in Iran by 2030. New-build projects lead the count and are also set to account for over 90% of the country’s total capacity additions by 2030. Among these, Jask II is a major refinery project with substantial capacity additions during the outlook period. Petro Tejarat Shahin is the operator and equity owner of this new-build project. Currently in the front-end engineering design stage, the project is expected to commence operations in 2028 with an announced capacity of 6,000 barrels per day (bpd). Other significant new-build projects such as Siraf and Shahid Ghasem Soleimani further underscore Iran’s commitment to expanding its refining capacity during the outlook period. Iraq is expected to follow Iran in terms of refinery capacity additions, with nearly 1.9 million barrels per day of capacity expected to be added by 2030. The country’s refinery landscape is equally shaped by both new-build and expansion projects. New build projects lead the capacity additions in the country, accounting for 65% of the total capacity additions by 2030. Around 28% of the upcoming refinery capacity is under construction while the remaining is in the preconstruction stages.

Basra II is a major refinery new-build project in Iraq with substantial capacity additions of 300bpd during the outlook period. South Refineries is the operator and equity owner of this project set to begin operations in 2027. Maysan and Nassiriya II are some other major new-build projects with significant capacity additions during the outlook period.

Oman stands third in terms of refinery capacity additions, with nearly 695,000bpd of capacity expected to be added by 2030. New-build projects account for most of the capacity additions in the country. Among these, Duqm IV and Duqm III are some major projects with substantial capacity additions, with 300bpd and 200bpd, respectively. Further analysis on global conventional refinery projects can be found in GlobalData’s new report, Conventional Refinery New Build and Expansion Projects Analysis by Type, Development Stage, Key Countries, Region and Forecasts to 2030.