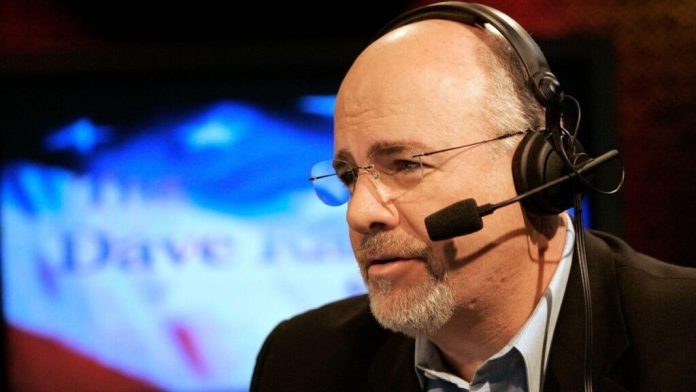

Steve from Greensboro, North Carolina, called into “The Ramsey Show” with an impressive financial profile: no debt, retired at 78, and sitting on a $5.4 million net worth. But personal finance personality Dave Ramsey wasn’t impressed by everything he heard.

Steve explained that $1.8 million of his money—34% of his entire net worth—was tied up in a single stock in a taxable brokerage account. The stock had appreciated from a $58,000 cost basis, meaning almost the entire amount would be taxed if sold. “I absolutely hate paying capital gains tax,” Steve said.

Don’t Miss:

Ramsey understood but didn’t sugarcoat his advice. “You’re going to trade some taxes for some safety,” he said. “Diversification equals safety. Or you’re going to take the risk because you don’t want to pay the taxes. It’s a simple formula.”

Steve said his income this year would be around $160,000, leaving room for him to realize up to $400,000 in gains and still stay in the 15% federal capital gains bracket. Ramsey urged him to take advantage of that. “The 15% is not just tax, it’s the cost of safety due to diversification versus lack of diversification,” he said.

Ramsey even looked up the current income threshold and pointed out that for a single filer in 2025, the 15% bracket goes up to $566,000. “So if you got $160,000, that leaves you $400,000 that you could move a year and still not be at 15%,” Ramsey said.

Trending: An EA Co-Founder Shapes This VC Backed Marketplace—Now You Can Invest in Gaming’s Next Big Platform

Ramsey acknowledged Steve had done a lot right, but he made it clear he doesn’t believe in holding individual stocks long-term. “I don’t buy single stocks. And the lack of diversification is one of the reasons,” he said.

Co-host John Delony pointed to examples like Enron and recent volatility in Tesla (NASDAQ:TSLA) to drive home the point. “I just get itchy because I grew up in Houston when Enron went away, and I had friends and family that worked at Enron. That just makes me nervous,” he said. “Or just thinking about what Tesla was a year ago versus what it is right now.”

Ramsey warned that one unexpected move by the company could slash Steve’s portfolio. “They can make the decision to do anything stupid and suddenly you could have a Bud Light moment.”