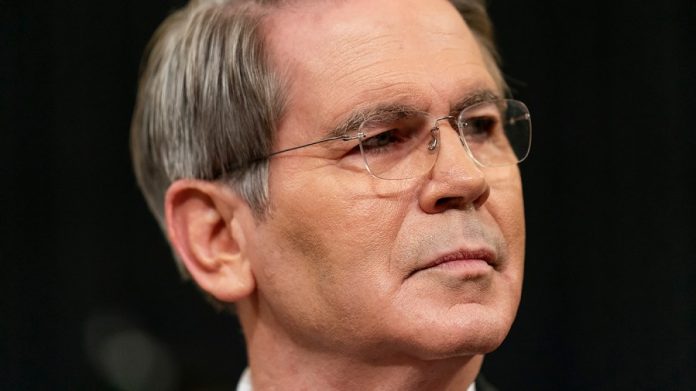

Treasury Secretary Scott Bessent said Wednesday that short term interest rates should be 1.5 to 1.75 percentage points lower than their current level, keeping up the administration’s pressure campaign on the Federal Reserve.

Bessent called for a half-point reduction in September at the next meeting of the Fed’s interest rate-setting committee, starting a series of cuts that would lower rates substantially below their current level of 4.25 to 4.5 percent.

“We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September,” he said on the Bloomberg News television network. “We should probably be 150, 175 lower. I think the committee needs to step back.”

Bessent’s remarks were his clearest yet on what should happen with short-term interest rates. Treasury secretaries, which handles debt issuance and tax collection, don’t traditionally weigh in on monetary policy, which is left to the Fed.

While Bessent has called the Fed’s independence on monetary policy a “jewel box” not to be tampered with, he has also joined President Trump and other administration officials in criticizing the bank’s handling of interest rates.

Trump has been calling for interest rate cuts since the beginning of the year and has nicknamed Fed Chair Jerome Powell “Too Late” due to his reluctance to begin cuts this year and the bank’s sluggish response to post-pandemic inflation.

The Fed has kept interbank lending rates at an effective level of 4.33 percent since January after making three cuts in the back half of last year. The Fed has been waiting to see the effects of tariffs on the economy.

Inflation held steady from June to July at a 2.7-percent annual increase in consumer price index (CPI) after ticking up from 2.4 percent in May.

The job market slowed down significantly over the past three months, adding just 106,000 jobs from May through July.

Asked Wednesday if a half-percent rate cut in September would signal that the fundamentals of the economy are not in good shape, Bessent said the signal would be one of transition.

“That signals that there’s an adjustment, and that rates are too constrictive,” he said.

FPowell has said recently that he believes interest rates are now “modestly restrictive,” meaning that inflation-adjusted interest rates are lowering potential profitability and restraining the level of investment.

Bessent criticized Powell’s reliance and reactivity to incoming data, which the Fed chair has often stressed during his tenure as chair.

“He’s not Alan Greenspan, who was very forward-thinking. They try to be more data-driven, which I think is a mistake,” Bessent said. “It’s just very old-fashioned thinking.”