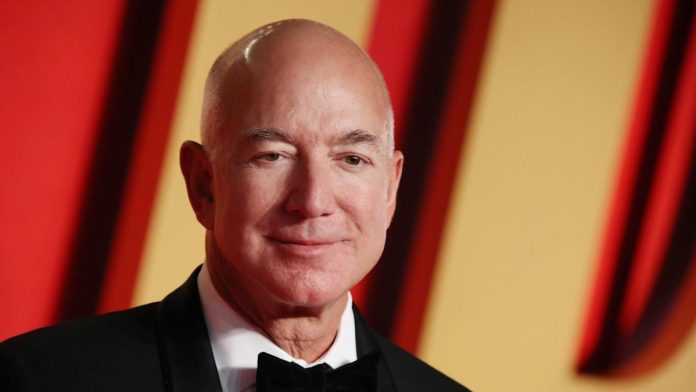

When one of the world’s wealthiest individuals makes an investment, it’s worth paying attention. As the fourth richest person in the world with a net worth of $244.5 billion, Amazon founder Jeff Bezos is one such person whose strategy is worth taking note of.

Discover More: Self-Made Millionaires Suggest 5 Stocks You Should Never Sell

For You: 25 Places To Buy a Home If You Want It To Gain Value

Since stepping down as Amazon CEO in 2021, Bezos has turned his focus to ventures like Blue Origin, but his investment footprint spans far beyond rockets and retail. Bezos has built a wide-ranging portfolio through Amazon, his venture capital firm Bezos Expeditions, Nash Holdings LLC and the Bezos Family Foundation.

From fintech and AI to agriculture and education, Bezos has backed companies that are shaping the future of technology, business and society. Check out the 13 surprising companies Jeff Bezos has invested in that might be worth a spot in your watchlist too.

In April 2017, Bezos invested $190 million from his cash flow during a Series D funding round for EverFi. The educational technology company focuses on financial education, social and emotional learning and STEM and career readiness, among other offerings.

According to the EverFi website, the company is “fulfilling the need for scalable education in an ever-changing world.” Blackbaud, a cloud software giant, acquired EverFi for $750 million in 2022, and it’s unknown if Bezos has any involvement at this point.

During Series B funding in 2013, Bezos Expeditions followed super-investor David Sze with an investment in the private social media app, Nextdoor. This free app connects people who live in the same community and provides access to posts about neighborhood safety, jobs, lost pets and local politics.

NextDoor was acquired by Khosla Ventures Acquisition Co. II, a special-purpose acquisition company, in 2024. The current share price as of July 25, 2025, is $1.88, with a market cap of $719.27 million.

Read Next: I Asked ChatGPT What the Stock Market Will Look Like in 100 Days — Here’s What It Said

In July of 2017, Bezos Expeditions invested in the future of food. Plenty is an agriculture technology company that develops plant sciences for crops to flourish in a pesticide and GMO-free environment. The ag-tech company received a $200 million investment from Bezos Expeditions during its Series B funding.

Plenty has raised a total of $941 million in funding over seven rounds. Their vertical farms grow veggies indoors, using only 1% of the water used in traditional agriculture, and produce crop yields up to 350 times greater than traditional methods.

The extremely popular accommodation marketplace provides access to millions of unique places to stay in more than 100,000 cities and 220 countries, and it received a Bezos investment of $112 million, according to a Visual Capitalist report.

Airbnb priced its IPO at $68 per share in December 2020, giving it a $47 billion valuation, which indicated that Bezos would earn a decent payday. Currently, shares are trading at $141.31, and it has a market capitalization of over $87.22 billion.

Bezos appears to be trying to make the world a better place by supporting companies like Grail, a healthcare company focusing on detecting cancer early before treatments become too invasive.

In 2016, Bezos Expeditions invested $100 million in Grail. Grail raised over $2 billion in funding and announced an IPO in September 2020, but just one week later, Illumina announced it’d buy the company for $8 billion and that Bezos would be bought out.

Bezos Expeditions invested $27 million in Series B financing for Mark43 in April 2016. Bezos was also part of the $38 million Mark43 secured in its Series C round of funding.

Mark43, founded in 2012, aims to improve public safety software. Amazon Web Services — Amazon’s secure cloud computing space — provides Mark43 support for its large criminal justice information security workloads.

This fintech company is helping people grow their small businesses by making access to credit simple, secure, fast and transparent. In September 2015, Fundbox was given $50 million by Bezos Expeditions and Spark Capital Growth in a Series C funding round.

Remitly is a mobile digital payment app that lets users transfer money across Remitly’s proprietary global network, which spans Africa, Asia, Central Europe and South America. Bezos was an early investor through Bezos Expeditions.

Though it’s no Amazon stock, the current share price for Remitly is $16.98, and the company has a market cap of $3.46 billion. Wall Street analysts believe that shares could shoot up in the short term as there is optimism over potential earnings growth.

Back in 2011, Bezos invested $37 million in Uber’s Series B funding round. The popular ride-sharing and food delivery app went public in 2019 at $45 per share, valuing the company at $82.4 billion. As of July 25, 2025, the stock is trading at $91.29 a share and has a market cap of $190.9 billion.

In 2013, Bezos invested $60 million in Domo, a company connecting CEOs to their front-line employees with access to real-time data and insights, allowing them to manage the business from their smartphones. Domo priced its IPO at $21 per share in 2018, raising $193 million.

As of July 25, 2025, the stock trades at $15.96 per share, giving it a market cap of $643.15 million. It’s worth noting that the cloud-based software company experienced a slowdown in 2023, and it’s unclear whether Bezos is still involved as of 2025.

Stack Overflow operates a public community platform where developers can ask and answer questions about coding. Additional products include several other tools that help companies overcome tech challenges. With over 23 million registered users and over 100 million monthly visitors, Stack Overflow is one of the world’s most popular websites.

Bezos was an early investor through Bezos Expeditions, which went on to fund at least one additional round of financing. However, Stack Overflow was sold for $1.8 billion to Prosus in 2021, and whether Bezos is still involved is unknown. The popular question-and-answer website is trying to utilize the power of AI, and it has integrated generative AI into its platform.

With the rise in prominence of AI-powered tools, Bezos Expeditions started focusing on this field. Last year, Bezos Expeditions, along with Nvidia and Microsoft, participated in a funding round for Figure AI to help raise $675 million at a $2.6 billion valuation. Bezos pledged $100 million.

The startup is working on building a humanoid robot that can perform undesirable jobs, available for commercial use. Analysts from Goldman Sachs predict the humanoid robot market could hit $38 billion by 2035, potentially disrupting the labor market.

Bezos Expeditions invested in the $73.6 million Series B round for Perplexity AI and the follow-on round of $63 million in 2024 as the company’s valuation climbed to between $2.5 billion and $3 billion. The AI-powered search engine relies on language models to provide results. The alternative search engine claims to provide more accurate results with a chatbot-style interface.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 13 Surprising Companies Jeff Bezos Bet On